Reasons to view the report

In Employer's Guide to Protecting Financial Wellbeing for the Workforce, you'll find practical guidance on how to support employees effectively:

- The problem with payslips (and how to make them better)

- 6 crucial areas where you should focus financial wellbeing efforts

- 9 ways to better support wellbeing, according to employees

- 3 essential components of a strong financial wellbeing policy

- Insights from leading HR, reward, and people management experts

- How to measure success in boosting financial wellbeing

*Note: Zellis latest Financial Wellbeing Report surveyed over 2000 people employed in the UK and Ireland about their financial well-being and literacy. Nearly 1/8 of those surveyed were employed in the Retail sector.

Working on the frontline of the cost-of-living crisis.

People working in retail are among those most impacted by rising inflation, concerns about finances and the associated stress and health problems they cause.

Understanding the perspectives and pressures on people working in retail and is important for employers to offer more effective support.

Surveying people working in retail across the UK and Ireland today has revealed the extent of payslip confusion and anxiety, as well as a growing disconnect with employers about the support and training, they need.

It also points the way to better, easier to understand pay and benefits processes for the entire industry.

Employer's guide to protecting financial wellbeing for the workforce

Last year, we conducted extensive research to understand how people feel about how they are paid, and the potential impact of payroll errors or even just lack of payslip clarity on their mental health. Some of the key findings of the overall report were:

- 73% are more worried about their finances today

- Almost half (46%) lack confidence when using numbers at work and in their lives

- 83% feel employers should focus on financial wellbeing

In many areas, responses from the retail sector stood out.*

Retail workers are more vulnerable to payslip errors.

Most work shifts or on an hourly basis, and their pay and benefits can vary. Half of those in retail surveyed work part time and 76% are paid hourly or on variable rates.

This makes it harder for people working in retail to quickly notice if their pay has been tabulated correctly. Even though only 44% of people working in retail say they always check their payslips, 27% have no confidence they could spot an error in their net pay.

Even so – a full 66% say they have noticed errors in their payslips before, more than any other sector apart from healthcare. This is a pressing issue as most (76%) say that they are more worried about their finances today than before the pandemic.

Payslips can be complicated, and low numeracy skills make that even more stressful.

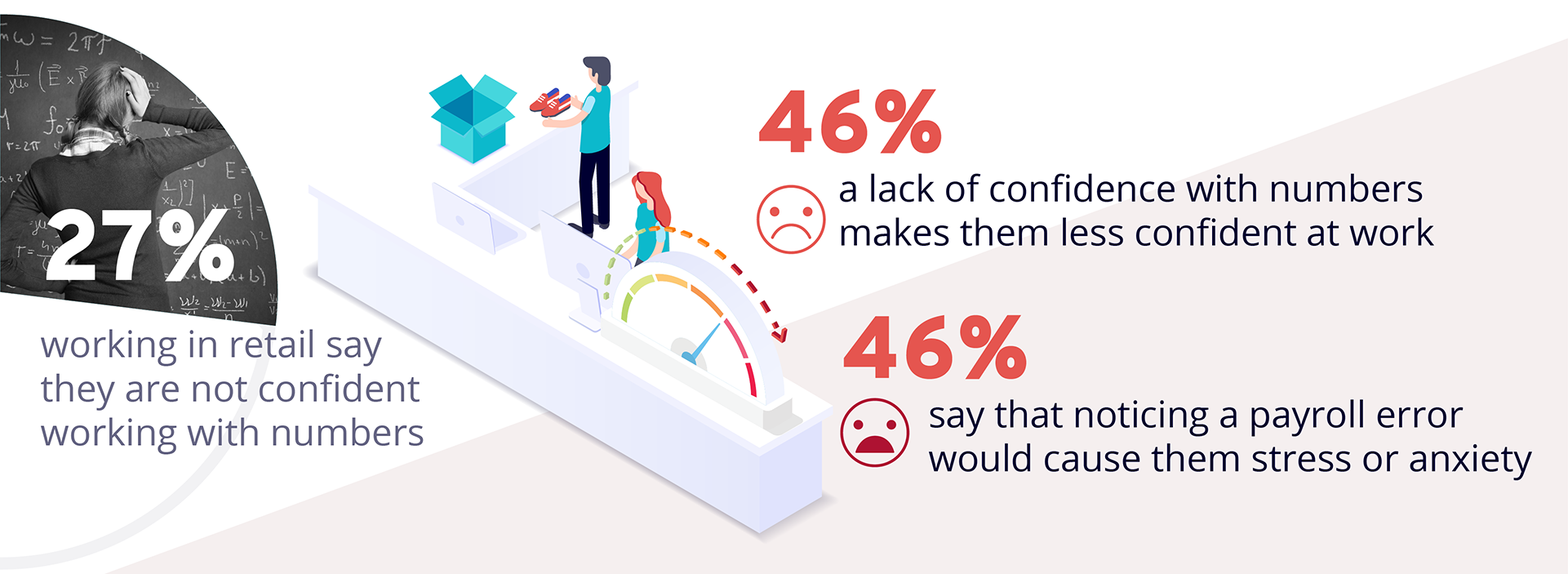

Over a quarter (27%) working in retail say they are not confident working with numbers, and more say a lack of confidence with numbers makes them less confident at work (46%) and worry it makes them less employable (22%). Nearly half (46%) say that noticing a payroll error would cause them stress or anxiety. Over half say that money worries affect them at work, 10% more than the overall average.

Podcasts

How we can help.

Simplifying payslip complexity

MyPay, our self-service payroll module, provides employees access to their payslips, making it easy to access all payroll documents, view payslips, and manage personal details. The mobile app allows anytime/anywhere access and is a key tool in supporting financial awareness by improving understanding of how benefits and pension contributions affect net pay

Employees using MyPay can view payslips through several breakdowns and visualisations. Making it easier to compare and plan pay, month by month. MyPay includes a comprehensive FAQ section to providing helpful information and guidance. This support tool can significantly reduce the number of queries directed to payroll and HR teams.

Retailers feel least supported by their employers.

Worryingly, people in retail where the least confident in getting payslip errors sorted with their employer. 17% said they have no confidence in their employer, and 34% say they would be ‘uncomfortable’ approaching their employer about an error with their pay, 8% above the average.

Retail workers were the least likely, of all sectors, to say their employer supported their mental health (51%), their physical (46%) or financial wellbeing (45%).

People working in retail are keen for more training, better management, and better tools.

They are more likely to say that better training for managers (41%), providing more education on payroll concepts (39%) and helping employees improve their numeracy (24%) are ways their employer could support their wellbeing. 72% say that having more confidence with numbers would have a positive impact on mental health.

But it’s not just a matter of education. Effective, clear and accessible tools are a clear priority. Retail workers were significantly more likely to say logging into their employer’s portal to access their payslip is a barrier to understanding (28%, 9% more than average).

How we can help.

MoneyHelper: financial support at your fingertips

We are committed to supporting the financial wellbeing of all employees and we are building access to financial resources and information directly from our platform.

Users of MyView can directly access MoneyHelper website. The site is backed by the UK government and provides free and impartial financial support. There is information on budgeting, banking, managing money, and reducing debt.

As the MyView product develops we plan to encourage responsible financial behaviours through automated notifications and positive reinforcement. For example, employees who often utilise the Earned Wage Access facility to gain funds ahead of payday will receive notifications reminding them of their pay status and encouraging them to pause and consider before continuing.

Earned Wage Access: a safety net for life's little dramas

Many people struggle to make ends meet and require short term assistance. To support such challenges, we have introduced ‘Earned Wage Access’.

With Earned Wage Access, employees have a critical financial safety net as they can obtain a percentage of their salary before payday. This helps people meet the cost of unexpected expenses like a tyre replacement or fixing a faulty boiler. By accessing wages, they have already earned the employee can avoid high interest rates that come with credit card debit and payday loans.

Earned Wage Access is available directly from the MyView app along with coaching and general advice to build good financial habits.

It’s not just about support – it’s about trust

Offering support, education and easier access to information and tools is critical to helping retail workers feel better supported by their employers, and for retail businesses to attract and retain the best. With 66% of people in retail saying payroll errors undermine their trust in their employer, this is clearly an issue that isn’t going away soon.

How we can help.

Wellbeing Support

Unlock the hidden value of employee benefits

Employee discount schemes are often overlooked but they can help cut costs. Studies have shown a marked deterioration in the population’s mental health and wellbeing since 2020. It should not be a surprise that the pressure of the cost-of-living crisis and resulting financial stress is having a physical and emotional impact on employees.

Some employer benefits packages can support employee health:

- Health cash plans letting employees claim for everyday costs such as opticians, dentists, physio, etc

- Gym membership - discounts can range from 10% and 40% of the membership.

- Private health insurance providing 24/7 online GP access, mental health support, second medical opinions and virtual wellbeing services

- Health Insurance cover often provide access a range of fitness, nutrition, and mental health programmes.

Work Report

Automation to simplify the financial decision-making processes

Payroll teams hold significant employee information. This data can be utilised for the benefit of employees. We have partnered with Experian and their Work Report solution to make life simpler for employees. By working together, we have simplified the process of applying for loans, mortgages, and tenancy agreements by eliminating the manual process involved in, gathering income and employment data.

This reduces the time taken to process applications and removes the administrative burden for HR, Payroll, and employees.

Employees have the option to ‘self-serve’, sharing the information they want directly, and securely with the organisation of their choice, eliminating the time and effort HR teams currently spend sourcing, printing and verifying documents.

Reasons to download this report

In Employer's Guide to Protecting Financial Wellbeing for the Workforce, you'll find practical guidance on how to support employees effectively:

- The problem with payslips (and how to make them better)

- 6 crucial areas where you should focus financial wellbeing efforts

- 9 ways to better support wellbeing, according to employees

- 3 essential components of a strong financial wellbeing policy

- Insights from leading HR, reward, and people management experts

- How to measure success in boosting financial wellbeing

*Note: Zellis latest Financial Wellbeing Report surveyed over 2000 people employed in the UK and Ireland about their financial well-being and literacy. Nearly 1/8 of those surveyed were employed in the Retail sector.

You're in safe hands

Talk to our team of experts

Want to learn more? Our payroll and HR experts are always on hand to discuss your organisation's challenges and share more insights on how we help the retail sector

.png)